Speeding Up Payment Collection with Robust Accounts Receivable Reports

Accounts receivable reports are a critical tool for businesses of all sizes, providing valuable insights into the financial health of the organisation. These reports provide a comprehensive overview of the company's outstanding debts, enabling business owners and finance teams to make informed decisions about their cash flow and financial management. In this article, we'll discuss the importance of accounts receivable reports and why they are crucial for every business.

Every business should have several key accounts receivable reports to help them monitor their outstanding debts and make informed decisions about their financial management. Here are some of the most important accounts receivable reports that every business should have:

Accounts Receivable Aging Report: This report provides an overview of outstanding debts, broken down by age bracket. It can start with standard 30-day periods, and then expand to 31-60 days, 61-90 days, and over 90 days. This information is critical for managing the company's cash flow and ensuring that debts are collected in a timely manner.

Customer Invoice Report: This report provides a detailed list of all invoices issued to customers, including the amount due, payment status, and due date. This information is crucial for tracking the payment patterns of customers and ensuring that debts are collected in a timely manner.

Customer Balance Report: This report provides an overview of the outstanding balance for each customer, enabling businesses to track their debts and identify potential credit risks.

Credit Hold Report: This report lists all customers who have been placed on credit hold, along with the reason for the hold and the status of the debt. This information is critical for managing the business's credit policies and ensuring that debts are collected in a timely manner.

Cash Receipts Report: This report provides a detailed breakdown of all cash receipts, including the customer, the amount received, and the payment method. This information is crucial for reconciling cash receipts and ensuring that the business's financial records are accurate.

Sales by Customer Report: This report provides an overview of sales by customer, enabling businesses to track their sales trends and identify their top-performing customers.

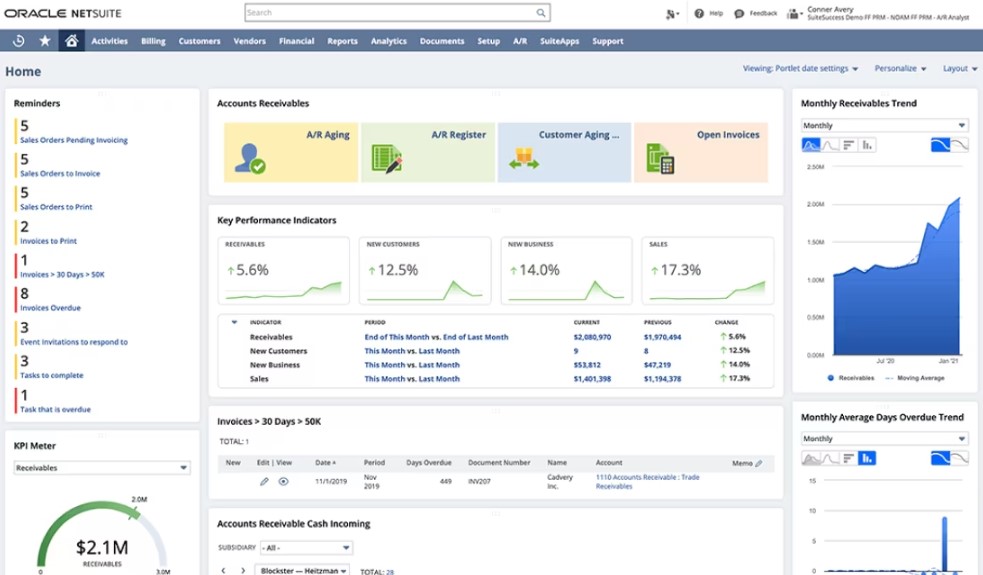

Creating accounts receivable reports manually is a thing of the past for businesses as many software solutions are available to compile them easily. With NetSuite's automated accounting software, businesses get "out of the box" real-time reports, but users can also create modified reports, giving AR teams the ability to match customer payments to invoices as they arrive and providing owners and managers instant insights into the receivables and general financial health of the company.

The AR dashboard within NetSuite gives the ability to see key performance indicators with configurable, real-time receivables, aging, and history reports. The AR dashboard includes visual representations of key metrics such as outstanding balances, overdue invoices, and payment trends, which can be customized to meet specific business needs. With the AR dashboard, users can quickly and easily track the status of their customer payments and make informed decisions about their cash management strategy.

You can contact us via e-mail hello@accosuite.com or call us + 372 660 3018

or read more about NetSuite benefits from our webpage https://accosuite.com/our-services/netsuite-consulting